This is a question I get all the time. What is financial coaching? I like to explain financial coaching by comparing it to a familiar dynamic of a sports coach. What does a sports coach do?

Let’s start with the mindset. A sports coach wants to win and wants every player he or she coaches to reach their potential. To win, the coach keeps a positive and encouraging mindset while finding ways to challenge each player individually. What does a coach work on with a player? It depends upon that player’s situation and position. In football it would make little sense for a defensive line coach to work on punting or passing with a defensive end. Those are not skills a defensive player needs. Similarly, the quarterback really doesn’t need to spend time kicking field goals. Instead, a quarterback coach will work on drills particular to that position, so passing drills would be part of a workout. A coach also works with a player based on his or her particular needs. A coach might help one quarterback learn how to read a defense while helping another quarterback improve mechanics of his throwing motion. The differences in the plan for each player are tailored to the needs of each player. The coach wants to help the player grow and improve, so the plan is as individual as the person.

Financial coaching follows the same approach. There is not a one size fits all template. For a young couple in their twenties, the coaching might include financial planning for children’s college funds, counsel on paying off student loans, and starting to understand some investing basics. If two couples of the same age have different circumstances – say a single nurse compared to a husband and wife dentist team – then the coaching would be as different as the people, their circumstances, and their goals. Just in the sports world, if a player is new to the sport, it would be appropriate to cover the basic rules and philosophies around the sport.

The same concept carries over to the financial world. If someone is not accustomed to handling money, like a new college grad or a widow whose husband managed their money, a financial coach should lean in to the basics and help these folks understand money management concepts. Budgeting, sinking funds, and planning for bills become important topics.

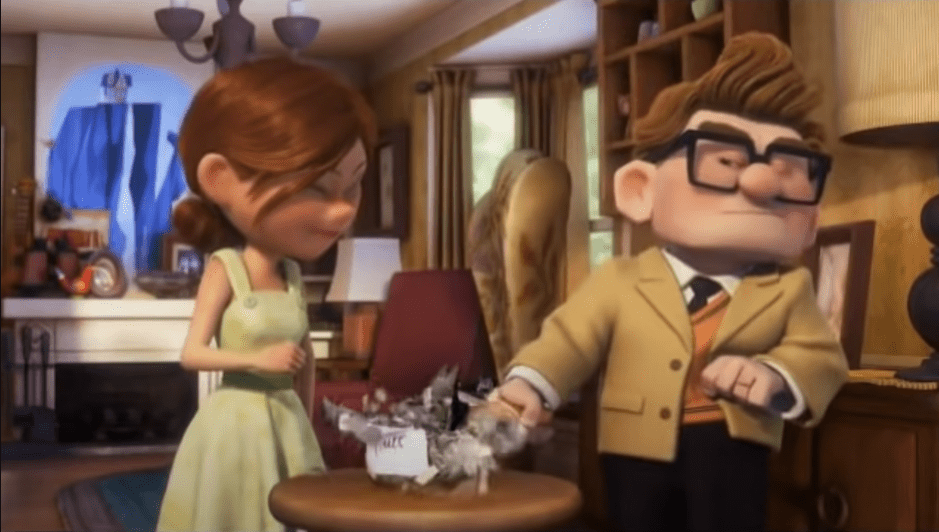

For those who might be more experienced in handling money, there could still be specific problem areas or hot spots. Take Carl and Ellie for example. The sweet couple from the movie “Up” were always saving for a trip to Paradise Falls when an unexpected expense would arise prompting them to repeatedly break their trip money jar to handle the emergency.

Carl & Ellie needed an emergency fund

A financial coach could work with Carl and Ellie on a strategy for creating a separate and larger emergency fund so their trip fund could stay intact when they have a flat tire or have a medical emergency. A teacher looking to afford a house but concerned that she will never be able to save up for the down payment could benefit from a coach reviewing her budget and providing tips on auto drafting into a house fund account. A family wanting to start a college fund. A thirty-year old trying to figure out how to get rid of student loans. A family tired of living paycheck to paycheck. A widower unsure if his savings will last through his golden years. A 17-year-old wanting to go to college debt-free. Each of these people could benefit from the insight and personal focus a financial coach provides.

My role as a financial coach is to be firmly rooted in principles of personal finance. Sure, I know the math and can walk you through calculations and what if scenarios. The real value I bring is understanding that finances are personal. That means our conversations are confidential and tailored to your needs. That means I pay as much attention to where you are in life and to what your circumstances and goals are as I do to the math. It means one size does not fit all.

Tired of the “One Size Fits All” financial plan?

The foundational money principles that I teach are based in biblical truth and common sense. They are the same principles I have lived by all my life. They are the same values that undergird how I manage my own finances. While those principles are time-tested through countless generations, as a financial coach I help you apply those principles to your season in life and your circumstances. Just as a good sports coach helps a player improve their game so they can win in the end, that’s exactly what I do as a financial coach. I will help you learn to Manage Your Dollars With Common Sense.

To learn more about working with a financial coach, check out my website or blog. Initial consultations are always free to make sure I am a good fit for you as a financial coach before moving forward.