Welcome! You are a month into a new year. Many of us kicked off the year with celebration, reflection, and promises of things we wanted to do better moving forward. Often reflection leads us to resolve to eat better, exercise more, lose weight, and be better at handling our money. For those wanting to improve their financial situation, there is one very important mistake to avoid. While it is easier said than done, it can make a big difference when it comes to hitting your financial goals.

Before I get to the financial talk, let’s take a quick trip down analogy alley. When you get in the car to run an errand, take a trip, or visit a friend, you have the end point in mind. You know your route or you have a navigation app on your phone to tell you the steps to take to reach your destination without wasting gas and going way out of your way. While there are endless detours and paths you could take, the most efficient way is to follow the plan you laid out as long as your plan is a good one.

Reaching your financial goals works the same way. To get to your goal the fastest way possible, set a plan, and follow the plan. The number one money mistake is failing to plan. Imagine getting in your car and heading off in a random direction with only a vague idea of where you are going to shop and eat. After driving aimlessly for an hour, you pass by a store and suddenly decide to shop there. You’re not sure what you are shopping for, how much you will spend, or how long you have, but you are happy to be there. After a spending spree, you decide you are hungry and return to your car only to find that your wandering habits drained your gas tank. You don’t have enough gas to get to your favorite restaurant without gassing up the car. You fuel up and drive to dinner so you eventually get to your goal, but it took much longer and cost more money than you ever thought it would.

Walking though life without a financial plan means the path to your financial goals will take you longer and be much more expensive than they could have been. In fact, if you aren’t careful, you may run out of gas and not get there at all.

If the term “financial plan” sounds formal and intimidating, let me simplify it. A short term financial plan is simply a budget. A longer term plan involves setting goals, saving, and investing, but without taking the time to plan and track how you use your money each month, you are wandering around wasting time and money. Because your long-term goals will be the result of a series of short-term decisions, let’s focus on the short-term plan, the budget.

A budget is a spending plan for how you’ll use your money each month. It is a common sentiment that budgeting is important. Most people also agree that flossing their teeth is a good idea, but in both cases, knowing something is important and making a habit of doing it are two different things. Some people love the control that budgeting gives them, but for others creating a budget sounds hard. It doesn’t have to be hard, but it is a discipline to be mastered.

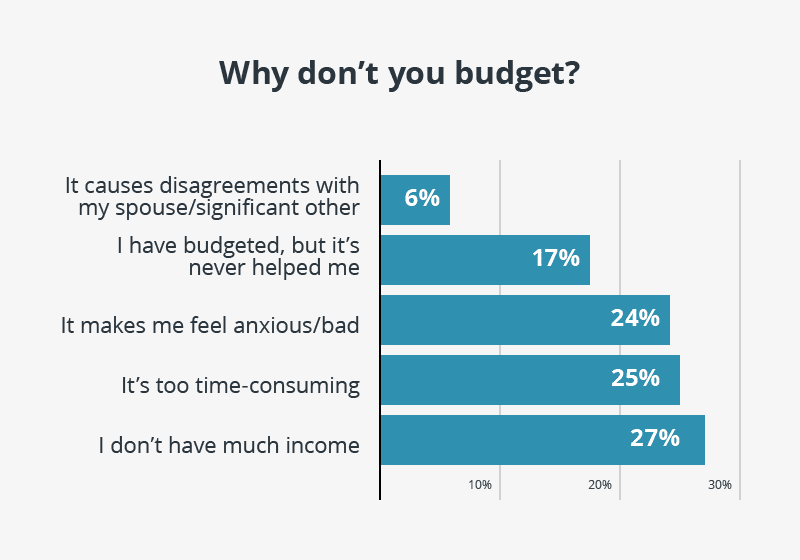

According to Debt.com, there are a lot of reasons people don’t budget. Most focus around discomfort. Most new things are uncomfortable, but if you stick with them they will prove to be easier over time.

I’ll counter these objections and discomfort with some personal coaching stories. The first benefit of budgeting is the “found money” effect. Everyone I have coached has found at least a few hundred dollars per month of extra money when creating their first budget. One client found just over $1,000 per month that could be redirected toward her goals. Most people feel like they receive a raise when they start to financially plan for their month in writing. When you really start to plan and track your spending, you may be surprised at where your money goes. The grocery store, restaurants, coffee shops, and tollways are some of the gremlins that take your money when you aren’t paying close attention. Before you realize it, your bank balance is uncomfortably low. Planning your spending can keep the gremlins at bay and keep more money in your account.

– Photo by cottonbro studio on Pexels.com

After the “found money” is identified and redirected toward your goals, the second benefit of a budget is having a plan of attack for spending for the month. The choices are yours on how to allocate your money when you budget, but once you make those decisions, work your plan. Don’t let the emotion of the moment, hunger at the grocery store, or fear of missing out override your well-reasoned plan. If you are married, prepare the budget together and treat it as a spending pact. Disagreements on the budget between spouses represents an opportunity to align priorities and often results in a better marriage while working through differences together.

Having a plan doesn’t just give you a reason to say “no” it also gives you permission to say “yes.” If you have the money to do so, give yourself ways to enjoy your spending. Pamper yourself if you have the means to do it, but don’t go overboard. A spending plan allows you to have a category for a nail salon visit every month or a budget item for the home improvement store visit or a hobby you enjoy. Instead of these being spontaneous purchases that may put you in the red, planning an amount to spend gives you permission to spend without blowing up your plan.

There are a lot of other reasons to create a spending plan every month, but the last one I’ll hit on here is that a spending plan can support your long-term goals. Do you want a new car, but you never seem to have money when the time comes? Create an item in your budget to squirrel away a certain amount of your paycheck every month. Using recurring transfers, you can even automate the process and move the money to a savings account before you are ever tempted to spend it. Using this approach and saving in advance for your goals can save you money on the initial purchase, save you finance charges and interest payments monthly, and can ensure that money is there for your long-term goals when you need it. Whether it is an insurance premium payment, saving for a car, or investing toward retirement, your budget is a key tool to give you structure to your savings.

The old adage is that failing to plan is planning to fail. Don’t fall for the popular notion that everyone lives paycheck to paycheck. Planning your spending with purpose before the month begins, tracking your actual spending, and sticking to your plan will put you three steps ahead of the crowd. Plan your spending and your really planning to hit your financial goals.

For help putting together your spending plan, contact me to set up a consultation. I can help you assess your financial situation and step you through setting up your first budget. You don’t have to go it alone when you are improving how you manage your money.