You have heard the phrase “with great power comes great responsibility.” Consider the amazing power you carry with you every day. You carry a phone that can call anywhere in the world. That phone gives you instant access to a wealth of information on almost any topic on (or above) our planet. It is phenomenal power that we casually have at our fingertips daily and often use to play word games and complete puzzles. Hey, I play those games too, but let’s be honest and admit that we are really not using the power we have to its fullest potential.

Putting our cell phones aside for a moment, another staple in purses and wallets across America is the credit card. We can tap into more purchasing ability than we currently have in cash (more power!), but do we really understand the power – and responsibility – offered by that thin plastic card in our wallet?

Carrying a credit card is like always having a tiny little banker in your pocket. That banker is willing to make you very short-term loans all day every day. How wonderful! How cool! It is convenient, but with that great power, are you ready for the accompanying responsibility? It is good to consider that the convenience we gain may come at a cost.

Are Credit Cards a Good Deal?

Let’s examine the deal that your pocket-sized mini banker has in store for you. To make sure I found a typical example of a current credit card offer, I used my phone with its access to a great wealth of information to search for the best credit card deals. A NerdWallet article led me to some cards that were declared to be the best for me. I am familiar with tag line “What’s in your wallet?” from Capital One, so I picked the Capital One Venture Rewards Credit Card. That’s a terrible reason to pick a financial product but hit any college campus and you’ll see scores of students getting a credit card because it came with a free t-shirt. It doesn’t take much to convince us to get a card.

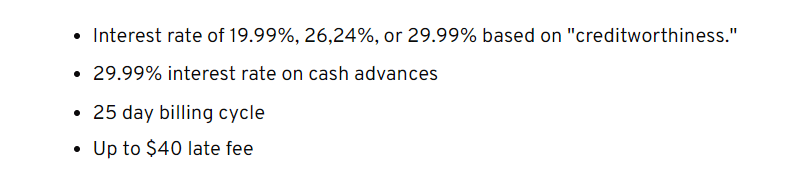

As I started to read the card terms, the NerdWallet site told me all the good news up front – I can get 2x-5x in airline miles, 75K bonus miles after $4,000 of purchases and other perks, all for a $95 annual fee. I’m not one for annual fees, but that seemed like a reasonably good deal so far based on all the perks. The rates and fees were buried under a section I had to expand about product details. When I followed the link, I learned the terms our Capital One mini-banker wanted to set:

Yikes! This pocket banker wants to loan me money at 20% interest (or more!) unless I pay it back in 25 days or less. That seems pretty steep. By the way, that 25 day cycle is intentional. Your bill is due on a different date each month, so your chance of missing a payment goes way up. It also allows the card company to have 14 billing cycles per year instead of 12 monthly cycles. This should be your first hint that the deck is not stacked in your favor.

Let’s look at this this credit card offer a different way. If I walked up to you in a grocery store and offered to pay for all your groceries using a very short-term loan, would you do it? The terms are to pay me back in less than a month, but if you don’t want to pay be back all the money, that’s okay. Instead, for any money you decide not to pay back, you will pay me a $40 late fee + $1.20 for every $1.00 I paid for your groceries. There is no way you are making that deal. You are assuming all the risk, and I am reaping all the rewards. That same deal is exactly the one you are making several times a day, likely dozens of times each month, with a credit card. You are taking out high-interest very short-term loans with the understanding that you need to pay each one back in full in under a month or you will owe late fees and interest.

If you have the money, why not just pay for the groceries and be done? That mini loan sounds like a terrible deal. If you pay me back one day late – in 26 days instead of 25 – you still owe me an extra $40 late fee + $1.20 for each $1 you borrowed. If you take out small very short-term loans for gas, groceries, your phone bill, your electricity — everything — eventually you are likely to miss a payment. Not you, of course. You don’t slip up like that, but most other people do. According to the Motley Fool, in 2023 the average American paid $1,657 in credit card interest payments. That means either people forgot to pay on time or weren’t able to pay their full bill. That $1,657 represents $138/month of interest. That isn’t terrible, but it does mean what’s in my wallet is less money. Take that $138/month per cardholder for the entire country and you might think you’d be talking about a pretty impressive sum of money. You would be right.

In the 12 months ending on March 31, 2024, Capital One made $51.1 billion dollars. Yes, billion with a “B.” They know what a great business it is to collect your interest payments and late fees, so they do everything they can to expand their business. In fact, they spent over $4 billion in marketing and advertising to make sure their card finds its way into your wallet. They pay Jennifer Garner between $3-4 million each year to smile and make you feel smart for carrying a Capital One credit card.

My point is not to single out Capital One. A Consumer Financial Protection Bureau report from October 2023 tells us that credit card companies charged more than $105 b-b-b-billion in interest and more than $25 billion in fees on a total outstanding balance of (take a breath) over $1 trillion. So… $1,000,000,000,000 of credit card debt. Those are staggering numbers!

With great power comes great responsibility. I’m not sure we as a nation of consumers are hitting the mark on that “great responsibility” part. That little banker in our pocket loaned us money – truckloads of money – and we paid back most of it. Even with our best intentions to pay off the balance every month, $1 trillion is still unpaid. So we pay late fees ($25 billion) and interest ($105 billion) each year. Image if the government operated that way. Oh wait, it does.

Hidden Cost of Credit

Credit cards seem like a great idea, one of pure convenience. Even if you tell me that you always pay off your balance each month (and good for you if you do!), you should still be aware of a few hidden costs of credit.

- You spend more with credit cards – MIT Sloan School of Management published a study that concluded credit card use activates the brain’s reward center resulting in the average person spending more with a credit card than when using their own money. Even if you pay your balance every month, you spend more when you are using other people’s money for the purchase.

- Paying increased prices – Credit card processing fees can typically run between 1.5% and 3.5% of a transaction’s value. Because the transaction fee is paid by merchants out of their sales, businesses tend to build that cost into the price of their products and services. The more credit card fees they pay, the higher the price of their products and services.

- Reverse Robin Hood effect of Rewards– I’m not trying to be a social crusader here, but facts are facts. Credit card points and cash back are perks offered by credit card companies to entice people to sign up for and use their cards. Those reward points are funded by the late fees and interest payment mentioned above, and the bulk of that revenue from fees and late payments is provided by folks who are unable to pay their entire balance. Said more bluntly, people who can’t make their credit card payments are funding your credit card airline points and cash back. It’s the opposite of Robin Hood. That might give you pause about accumulating points on the backs of people less well-off than you. It certainly was a reward buzz kill for me.

- It is harder to budget with credit – With a credit card you are buying something today that you won’t pay for until next month. That makes it very hard to budget. Are you budgeting for your actual spending – for the card swipes – or are you budgeting this month to pay for your purchases from last month? And if your August electric bill is on your September credit card statement and is not due until October, getting a clear picture of your expenses each month gets muddied in the process. If you pay as you go, budgeting is far easier to do.

Benefits of Flipping the Script

So how do you make sure the answer to the question “What’s in your wallet?” is “cold hard cash?” Brace yourself for a radical thought. What if you didn’t have to ask your tiny pocket banker for a loan every time you bought something? That’s possible if you pay for things out of your existing funds. Countercultural, but possible.

As an experiment, could you take the credit card(s) out of your wallet and leave them at home for, say, a month? What would happen? Reverse everything you read above this paragraph. If you are the average American, you’ll save $138/month of interest putting $1,657 back in your pocket for the year. Statistically, you will spend less money because your brain knows you are spending your money, which makes you take greater care in what you purchase and how much you spend. Budgeting becomes easier because you budget for what you spend that month, not for what you spent last month or have to pay off this month. No interest to pay, no late fees to fret over each month. No ugly credit card bills in the mail that make you scratch your head wondering how you spent so much last month.

Having a credit card isn’t wrong, any more than having a pet snake is wrong. Neither is something you should do without careful consideration. Do you know how to properly handle a snake? Do you understand the ramifications of owning a snake? If you are not thoughtful and careful of how you handle it, you might get bitten.

The struggle to get ahead is real and life is expensive, but there are alternatives to your tiny pocket banker. There are debit cards, digital accounts, and good old fashion cash. In a future article, I’ll handle whether it is truly possible to live without a credit card. You may not care to try or even to know that answer, and that’s certainly fine, but don’t buy into the myth that credit is essential to daily life. Life without a mini banker in your wallet is a life with fewer concerns, fewer fees, and a life where interest is the attention you pay to something, not money you owe Capital One.